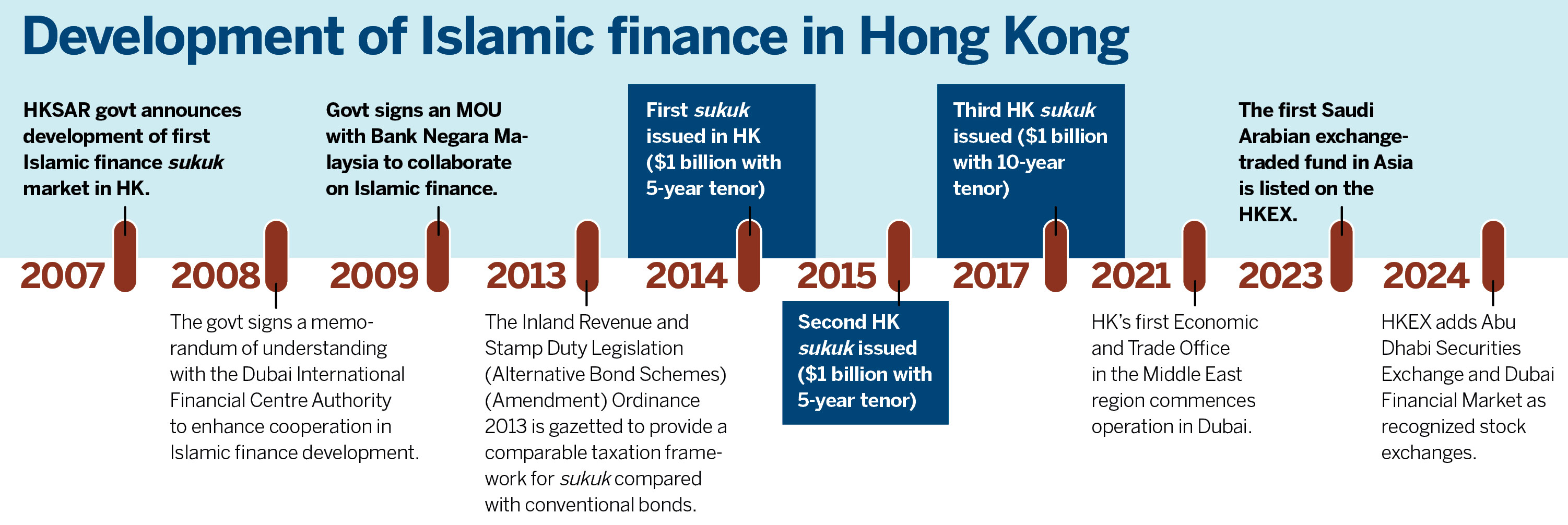

Hong Kong amended its regulations for Islamic bonds in 2013. Three sukuk totaling $3 billion were issued in 2014, 2015 and 2017. The Saudi Arabian exchange-traded fund listed in the city in 2023. In 2024, the Hong Kong Stock Exchange added the Abu Dhabi Securities Exchange and the Dubai Financial Market as recognized stock exchanges. Chai Hua reports from Hong Kong.

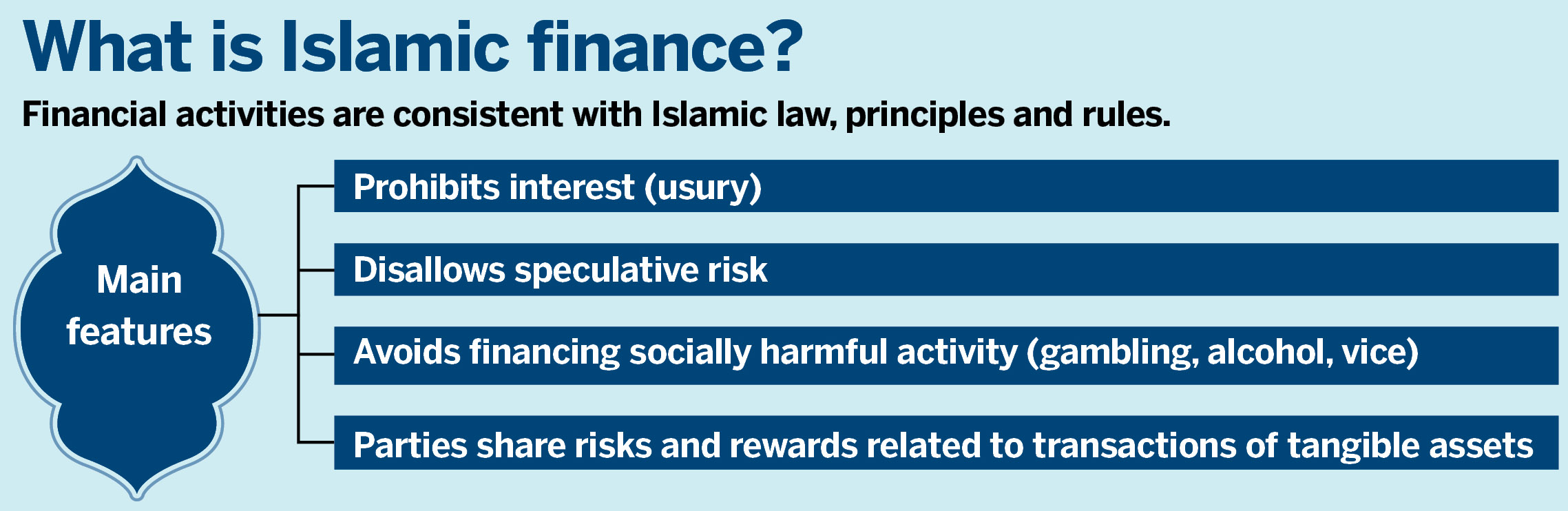

Islamic banking and finance comply with Shariah, the Islamic law, which prohibits usury, alcohol, gambling, drugs, pornography or pork-based trades. It is considered a culturally distinct form of ethical investing. No interest is charged on loans, and banks do not pay interest on deposits. Money is not treated as a commodity.

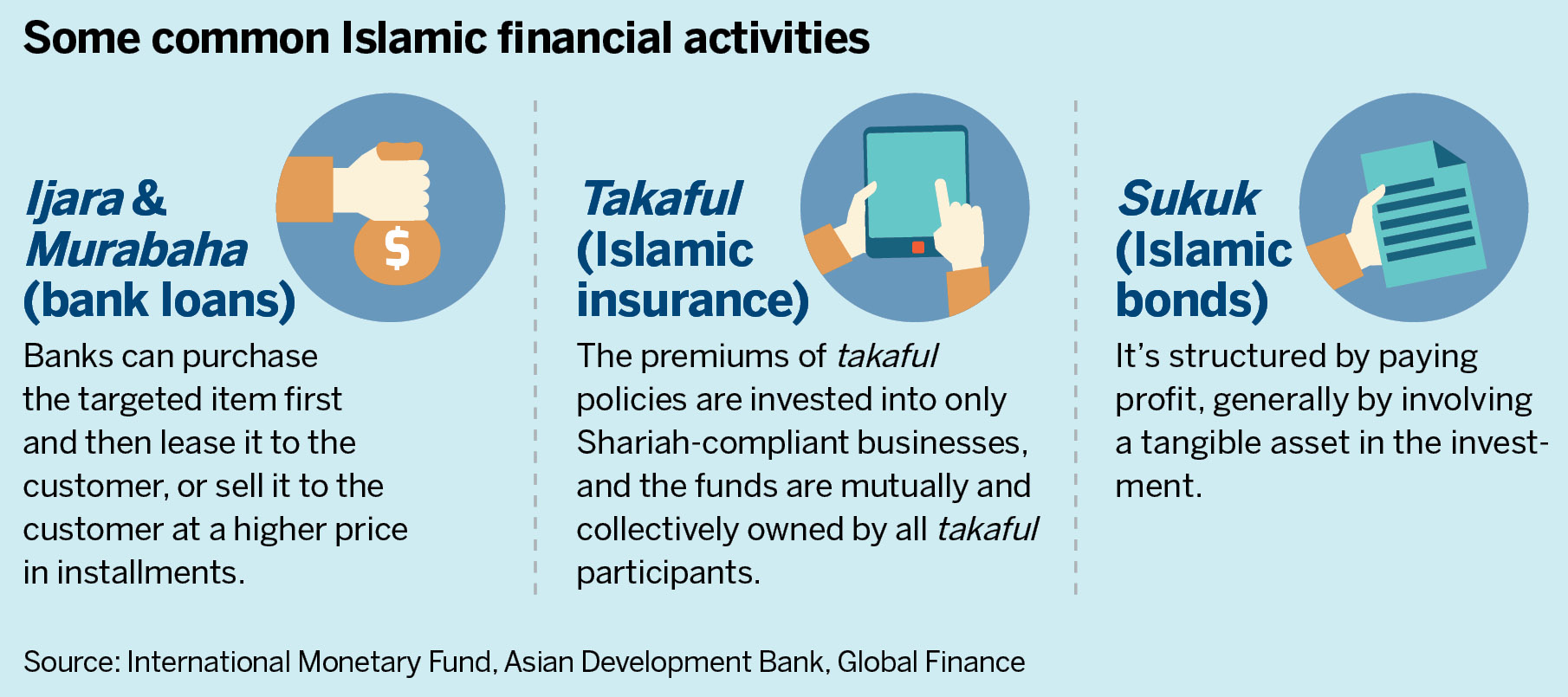

Financial products are mostly asset-backed and the bank and its customers equity-share the profits and losses on the asset, whether that’s a business, property, or service. Profits from deposits are shared with depositors at an agreed ratio, and paid as dividends.

Islamic banking customers can generally achieve similar returns to those available from conventional banks but with less risk, as Islamic finance avoids economic bubbles and speculation. The conventional banking system was badly impacted by the 2007-08 global financial crisis, due to excessive leverage and speculative investments.

READ MORE: Officials urge strengthened SE Asia, Middle East ties with HK

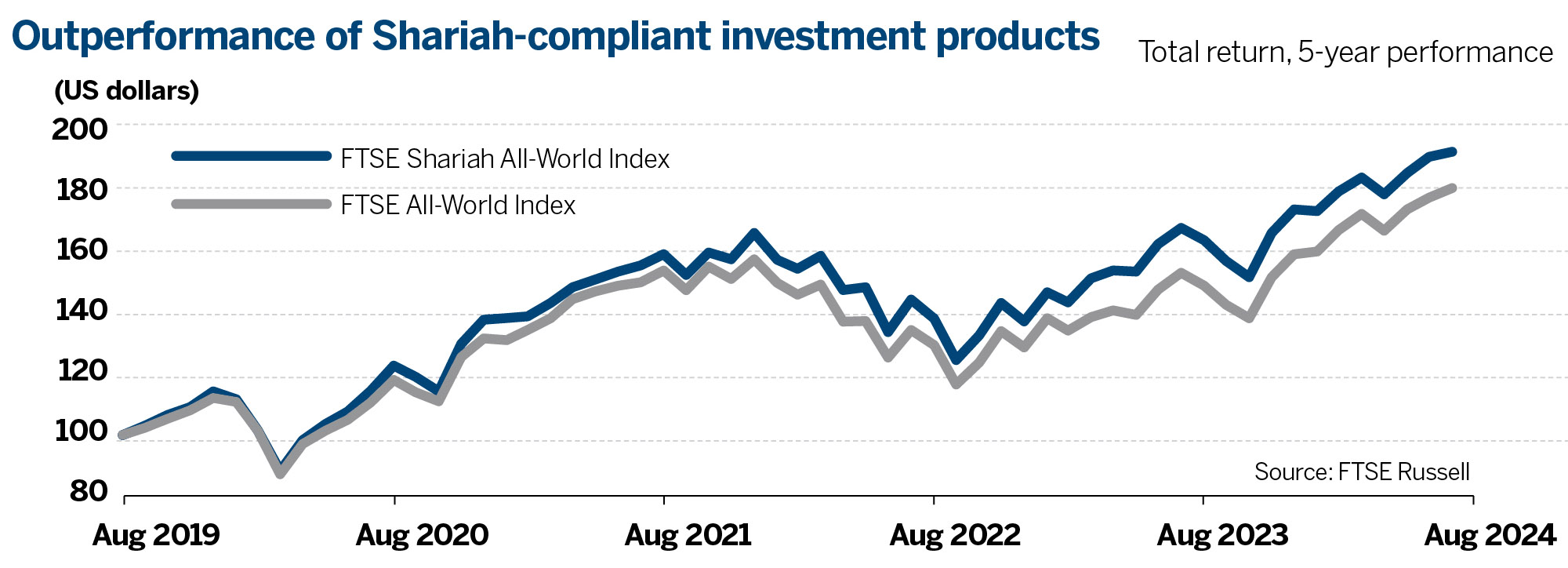

The market perception that investing in Islamic finance automatically leads to lower returns does not necessarily hold true, according to FTSE Russell research. A look back at the last 10-15 year period shows that the FTSE Shariah All-World Index has outperformed the FTSE All-World Index across most time frames.

However, it is not all risk-free. The first potential default of sukuk (Islamic bonds) was flagged by the Maldives, whose sovereign debt reached 110 percent of GDP in March, as recorded by the Observer Research Foundation. Bloomberg reported that the Maldives faces having to make a $25 million payment in October toward its $500 million sukuk debt. India is reportedly considering providing financial help.

Early start

Hong Kong was one of the earliest to promote the development of Islamic finance. As early as 2013, Hong Kong amended regulations for a conducive tax structure for sukuk issuance, and later included them under the Government Bond Programme.

In 2014, 2015 and 2017, three sukuk of different structures totaling $3 billion were issued in the city — all oversubscribed. “The three sukuk issuances have successfully demonstrated the viability of the Hong Kong platform, and that our legal, regulatory and taxation framework can readily support sukuk issuances,” said a Hong Kong Monetary Authority spokesperson. The market has seen few Islamic finance products since then, though financial relations with the Middle East continue to develop.

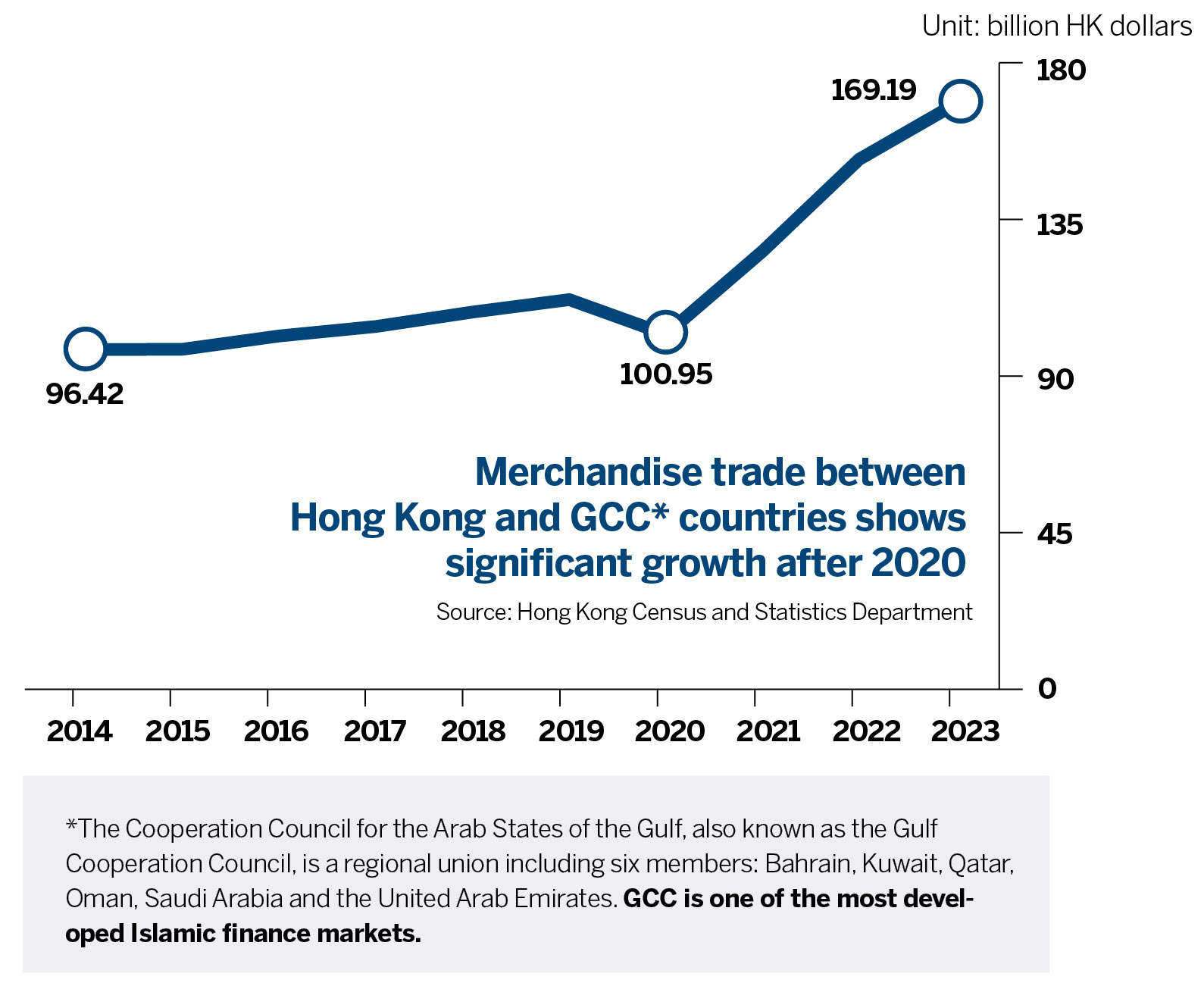

The first Saudi Arabian exchange-traded fund in Asia was listed on the Hong Kong Exchanges and Clearing in November 2023, which is recognized as a milestone of financial collaboration between Hong Kong and Saudi Arabia. In July, the HKEX added the Abu Dhabi Securities Exchange and the Dubai Financial Market as recognized stock exchanges, allowing public joint stock companies with a primary listing on the main market of these two exchanges to apply for a secondary listing in Hong Kong.

When leading a delegation to the Middle East in February last year, Chief Executive John Lee Ka-chiu said that Hong Kong, as Asia’s fund management hub and the largest green bond issuance center, can support the green and sustainable development needs of Middle Eastern countries. He also visited three ASEAN countries in July 2023, to strengthen trade ties and promote Islamic finance in Hong Kong.

Legislative Council member Robert Lee Wai-wang who represents the financial services sector, proposed that this year’s Policy Address should include plans to issue Islamic bonds again, denominated in multiple currencies, to further expand Hong Kong’s Islamic financial services and attract international funds for sukuk issuance.

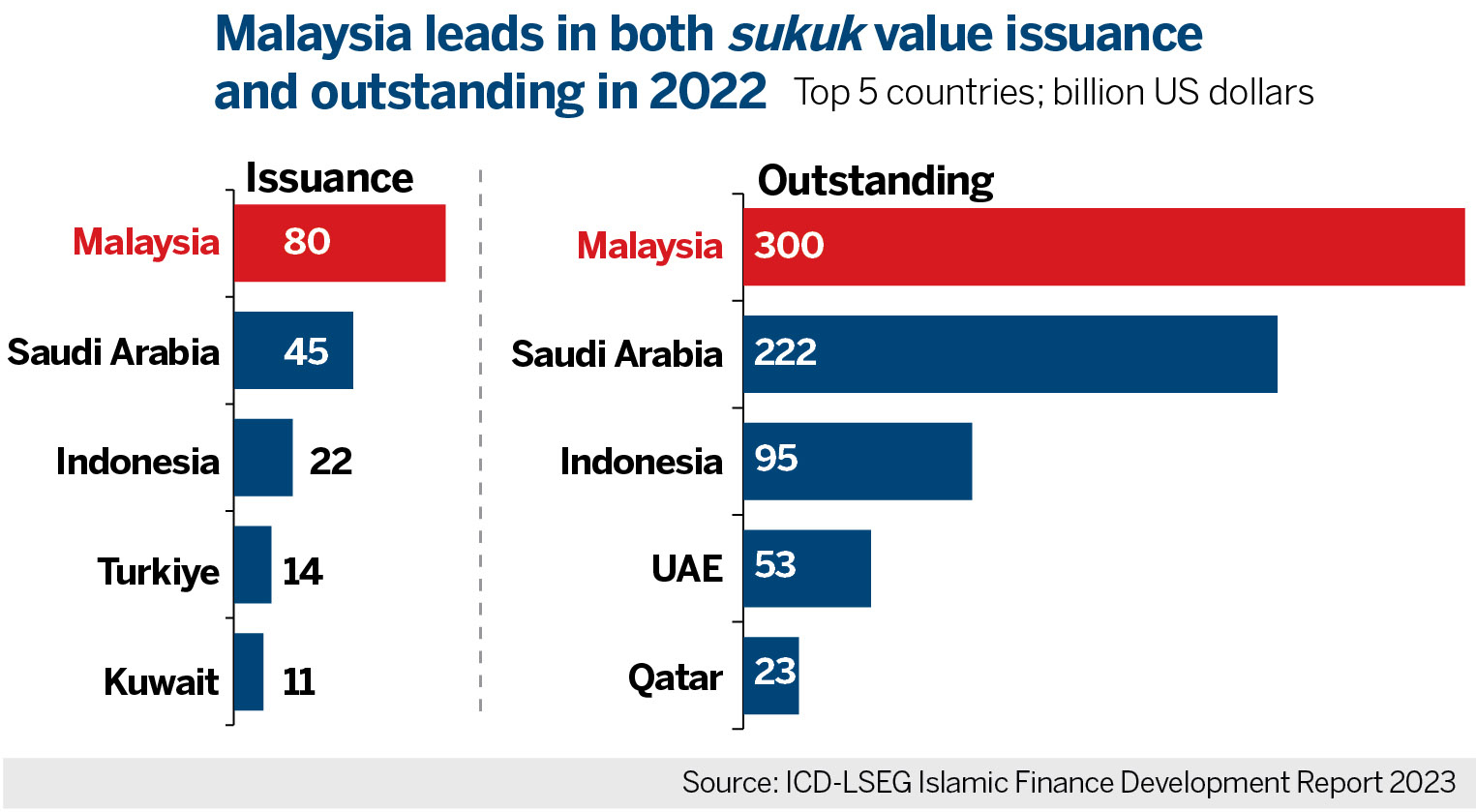

S&P Global Ratings projects there could be sukuk issuances between $160 billion and $170 billion in 2024, as the sukuk market started strongly this year, with total issuance reaching $46.8 billion on March 31, compared with $38.2 billion by the same date the previous year. The HKMA spokesperson confirmed in a written reply to China Daily that the authority will continue to promote Hong Kong’s financial markets to attract a diversity of businesses and financial institutions.

The HKMA also stated that the choice between conventional and Islamic formats for financial services and product offerings is ultimately subject to individual market participants’ decisions, for their own practical needs and relevant commercial considerations.

Not standardized

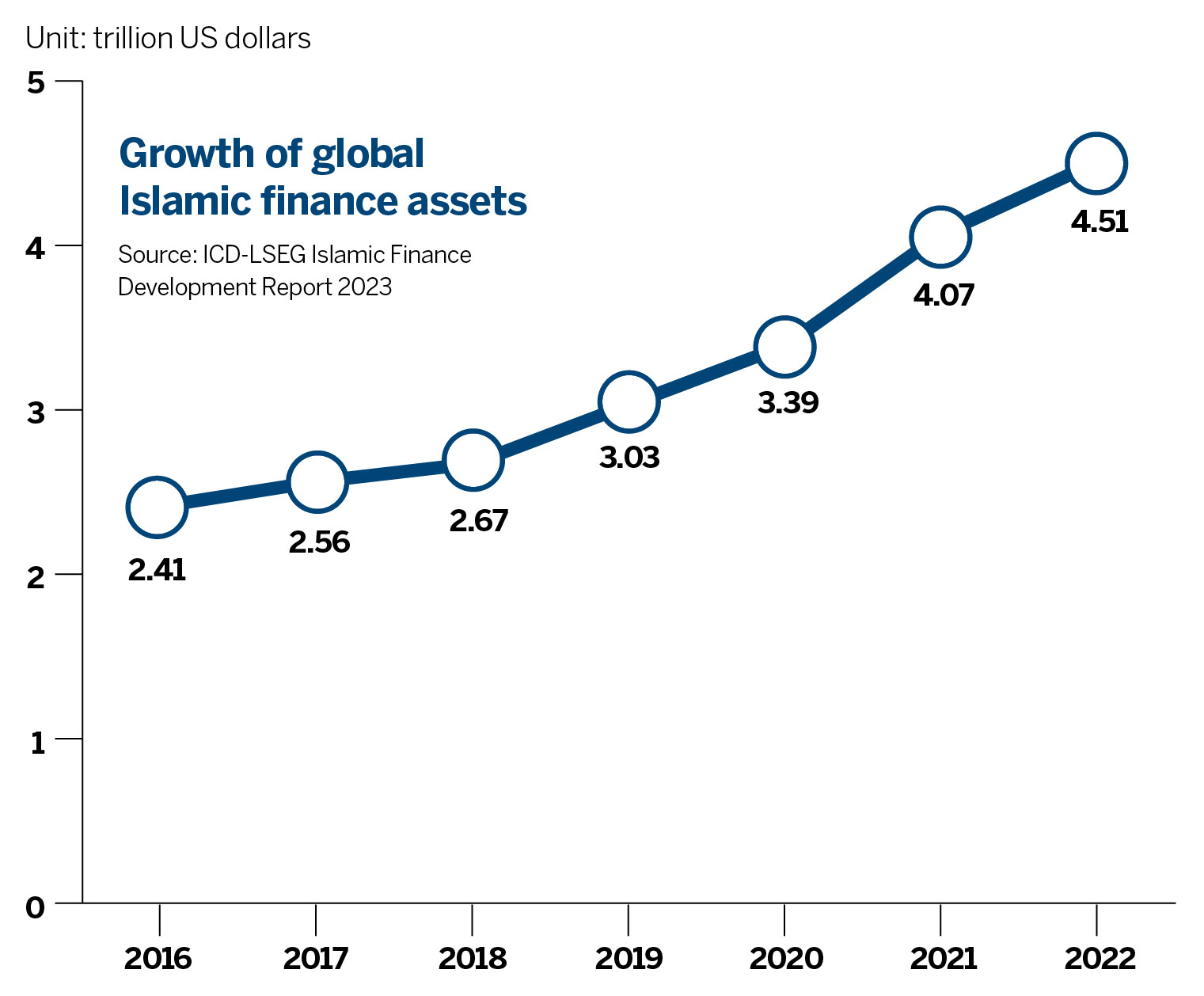

Between 2015 and 2021, Islamic financial assets grew to $4 trillion from $2.17 trillion. A 2022 report from the Islamic Corporation for the Development of the Private Sector (ICD) and Refinitiv projected they would reach $5.9 trillion by 2026. The ICD-LSEG Islamic Finance Development Report of 2023 forecast growth to $6.7 trillion by 2027. Comparisons of Islamic banking performance on a global basis are not readily available, as there is no standardized regulatory framework across jurisdictions.

Banking environments can range from well-understood dual banking frameworks like in Malaysia, to only Islamic banking jurisdictions like Iran. Islamic banking practice in Malaysia benefits from its robust dual banking ecosystem supervised by Bank Negara, its central bank, with the Shariah Advisory Council set up by Bank Negara monitoring compliance, products and services.

In 2005, Bank Negara set up the International Centre for Education in Islamic Finance, a specialized university to train and certify professionals for Islamic finance in Malaysia. Dow Jones of New York and RHB Securities of Kuala Lumpur launched an Islamic Malaysia Index of 45 Shariah-compliant stocks the same year.

Malaysia leads

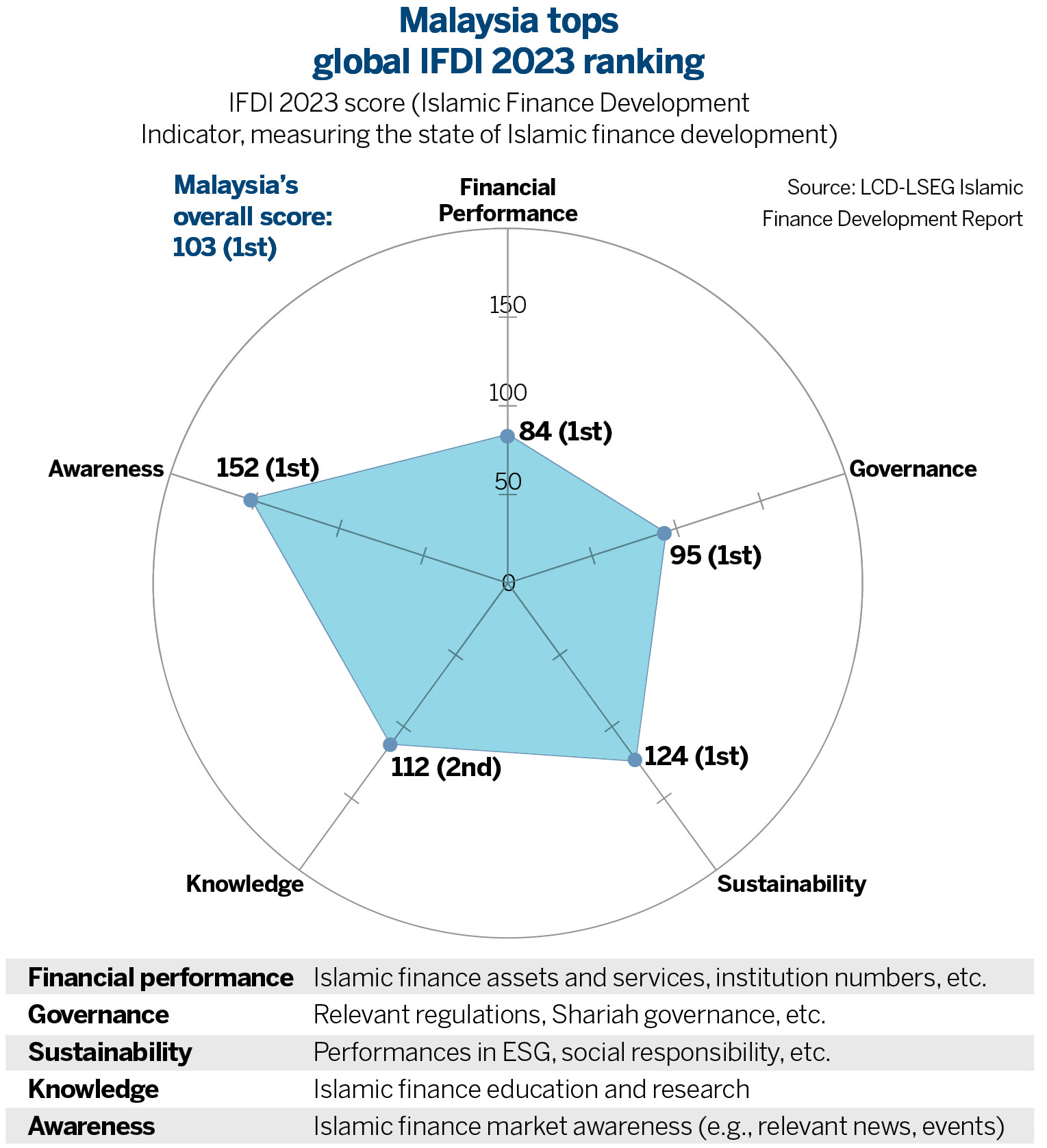

Malaysia’s first Islamic bank, Bank Islam Malaysia Berhad, was established in 1983. Ten years later, in 1993, commercial and merchant banks, and finance companies were allowed under the Islamic Banking Scheme to offer Islamic banking products and services. Malaysia leads in Islamic finance globally, ranking first for 10 consecutive years on the ICD-Refinitiv Islamic Financial Development Indicator. It leads the global sukuk market with a 39 percent market share.

The world’s largest Islamic bank is Al Rajhi of Saudi Arabia with equity of $28 billion and $216 billion in assets. It has operations in Kuwait, Jordan and Malaysia. Islamic banking took off in 1975, with many new interest-free banks in Muslim countries having opened since then. The objective was to establish a dual banking system, where Islamic banking coexists with conventional banking, particularly in countries in the Gulf Cooperation Council, Southeast Asia and South Asia (which account for over half of Islamic banking business).

As of 2020, there were approximately 47 financial institutions worldwide with more than $10 billion in Shariah-compliant assets, of which 27 institutions reported pretax profit of more than $500 million in 2019. Islamic finance is open to non-Muslims too. Singapore, Malaysia, and Australia released new services and products in that sector. Experts believe Islamic finance can contribute to the diversification of Hong Kong’s economy.

Takaful, a type of Islamic insurance, is also open to non-Muslims, where premiums of takaful policies are invested into only Shariah-compliant businesses, and the funds are mutually and collectively owned by all takaful participants — a fundamental difference from conventional insurance. Some takaful coverage can be more cost-effective compared with conventional insurance.

From a purely financial perspective, Islamic finance can be regarded as a basket of new investment tools, offering more choices for all investors.

S&P Global Ratings expects the total assets of the global Islamic finance industry to continue on its growth path, with high single-digit increases following a growth of 8 percent in 2023. From 2021 to 2022, the asset size of the global Islamic finance industry grew by 11 percent to $4.5 trillion.

Muslims account for about a quarter of the global population. They create significant demand in Islamic economies which also attract non-Muslim countries and regions. Singapore-based United Overseas Bank established its inaugural Islamic debt program of 5 billion ringgits ($1.2 billion) in Malaysia — oversubscribed 3.39 times in January. Australia plans to open its first Islamic bank this year. Meanwhile, Singapore asset manager Lion Global Investors and Brunei Darussalam’s BIBD Securities launched Singapore’s first Islamic liquidity fund in July.

Diversification

“Faced with the challenge of the sluggish stock market and intensified competition, Hong Kong needs diversified financial products and services to enhance its competitiveness and attractiveness,” said Liang Haiming, chairman of the China Silk Road iValley Research Institute and dean of the Belt and Road Research Institute at Hainan University. He added that diversified financial products can help spread risk and attract different types of investors. He recommended Islamic insurance, Islamic wealth management products, and Islamic green bonds.

Liang said the city can help establish globally accepted standards for the development and trading of Islamic financial products, as Islamic economies are increasingly seeking internationalization of their financial sector. “The Hong Kong Special Administrative Region government should establish a high-level special task team for Islamic finance. I believe the conditions are mature,” he said, adding that market research and legal support can follow to lay a solid foundation.

“Hong Kong’s multicultural and open economic environment is conducive to the development of Islamic finance. The mature financial infrastructure in Hong Kong can underpin the issue of Islamic financial products.” However, more effort is needed to establish a sufficient market, as the city’s Muslim population accounts for only 4 percent.

“For Islamic financial products to have an adequate market in Hong Kong, it is essential for the SAR government and the financial industry to enhance education and market promotion of Islamic finance, raise market awareness, and improve policy support and infrastructure,” said Liang.

“In Malaysia, Islamic finance has gained acceptance amongst all, irrespective of race or religion, and non-Muslims make up more than half of the customer base of Islamic banks,” said Yazrin Syakhairi, trade commissioner at the Consulate General of Malaysia in Hong Kong.

The country is one of the world’s top Islamic finance centers, with assets of about 3.8 trillion ringgits by the end of 2023, according to the Securities Commission of Malaysia. The Islamic capital market accounts for more than 60 percent of the nation’s total. Yazrin agreed that the SAR government needs more promotion for the public to understand Islamic banking. “Hong Kong can also initiate collaboration with countries that have niche capabilities in this segment such as Malaysia, for mutual benefit,” he suggested.

The Malaysia International Islamic Financial Centre and the Hong Kong Trade Development Council signed a memorandum of understanding in May, to innovate Islamic finance products, facilitate and promote cross-border activities, and implement capacity-building and education. In the same month, the HKMA delegation concluded a three-day visit to Kuala Lumpur, to strengthen financial collaboration.

“The prospects for Islamic finance are vast, without even considering the non-Muslims subscribing to such products,” said Yazrin. Citing data from the PEW Research Center, the world’s Muslim population is likely to be 26.5 percent of the world’s population by 2030, and to reach 30 percent by 2050. Currently, the population of Muslims is around 1.8 billion, 24 percent of the world’s total.

“Hong Kong can approach institutions with capabilities and experience (to act) as advisers in Islamic finance. There are banking institutions with such depth but the resources currently may not reside in Hong Kong.”

Middle East outreach

Besides Malaysia, the HKMA held bilateral meetings with the Central Bank of the United Arab Emirates and the Saudi Central Bank last year. The HKMA said it will continue to deepen collaboration in financial services, to promote investment and financial market connectivity between the Middle East and Asia.

“It is good to explore possibilities and attract investors from around the world, but it may take time as Islamic culture is quite different from ours,” said Kenneth Kwong Ka-kei, assistant professor in marketing at Hong Kong’s Hang Seng University. “Hong Kong, as an international financial center with mature infrastructure, has such capability, but we are not yet ready to launch a variety of Islamic financial products,” he admitted. Kwong is confident the two systems can integrate eventually, with more communication and exchanges, such as business tours and forums.

ALSO READ: HK bets on emerging markets to ride out economic headwinds

“The cooperation with the Middle East will not be confined to the financial sector,” he said, and suggested that Hong Kong should elevate education and training about Islamic culture in a broader sense. For instance, the HSU recently organized a talk to introduce Halal food. “In general, we are trying to attract Islamic investors like family offices with interest in both Islamic and conventional financial products. Familiarity with their culture is a must, no matter which investment direction they choose,” he added.

What's next

- Evolve a broader and deeper Islamic finance ecosystem.

- Intensify education, exchanges and promotion of Islamic finance.

- Increase market awareness among non-Muslim clients.

- Initiate cultural collaboration with Islamic countries.

Contact the writer at grace@chinadailyhk.com