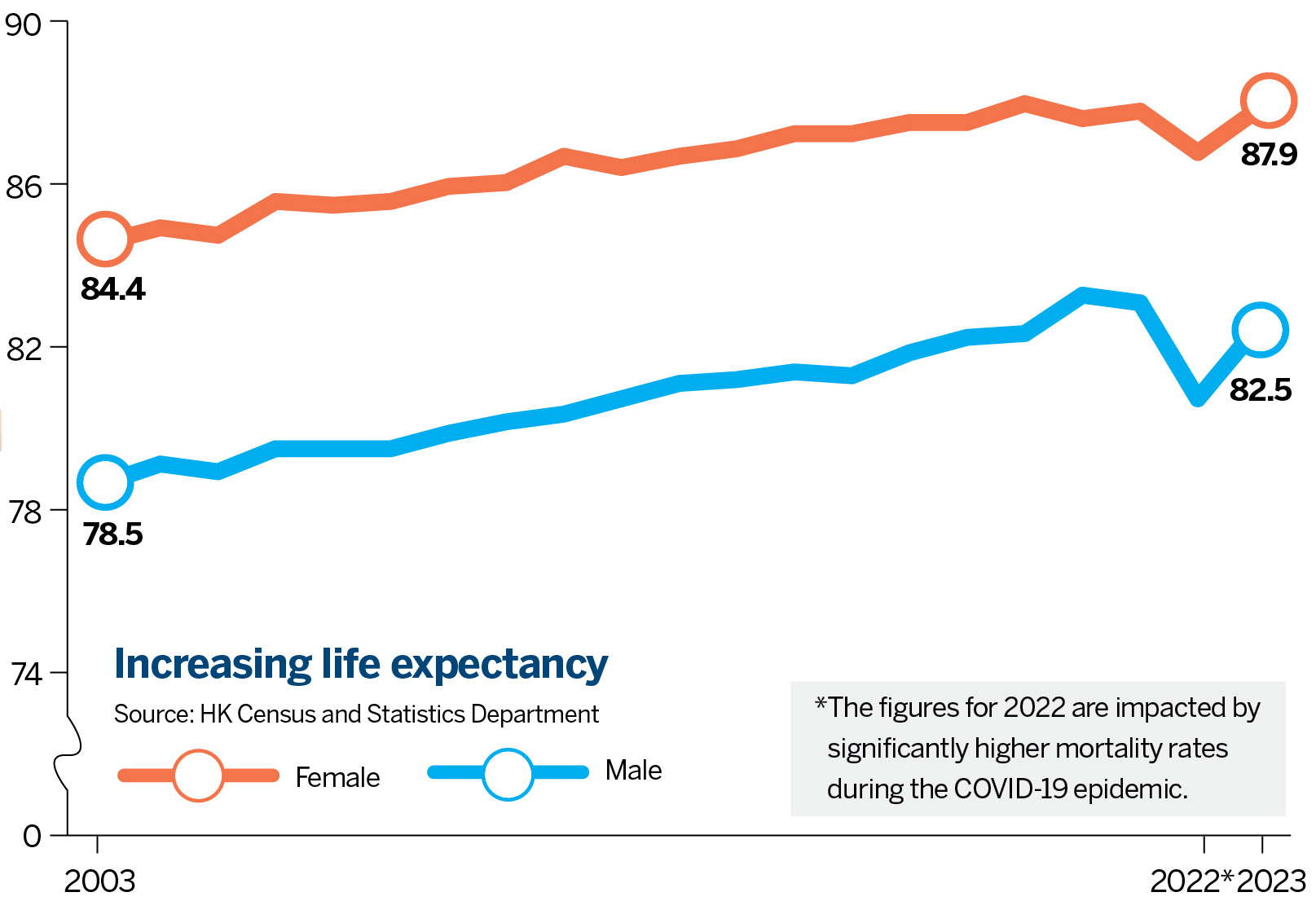

Experts forecast that 30 percent of Hong Kong’s population will be retirees of 65 years and older by 2036. Given today’s high life expectancy, many of them will live into their 80s, and may face two decades or more of financial hardship. Small family sizes mean they will receive less support from their offspring, while limited government welfare subsidies won’t fill the gap. Oxfam’s 2023 survey found that 40 percent of the elderly are living in poverty. Shadow Li reports from Hong Kong.

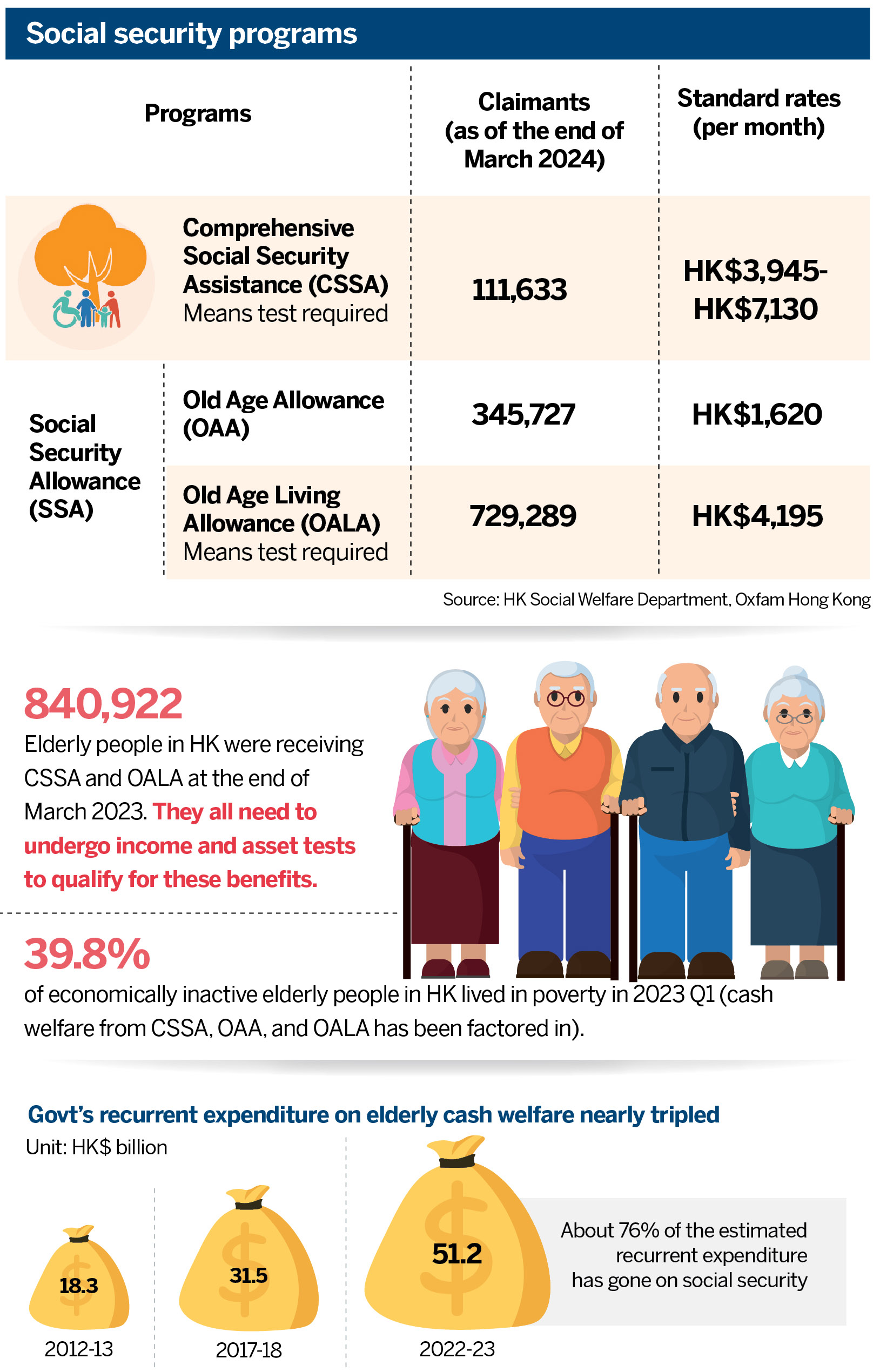

Hong Kong’s demographics show a mushrooming elderly population of retirees aged 65-plus each year. This is a ticking social time-bomb. Government expenditure on elderly welfare subsidies tripled from HK$18.3 billion ($2.34 billion) in 2012-13 to HK$51.2 billion in the 2022-23 financial year, constituting 76 percent of recurrent expenditure on social security.

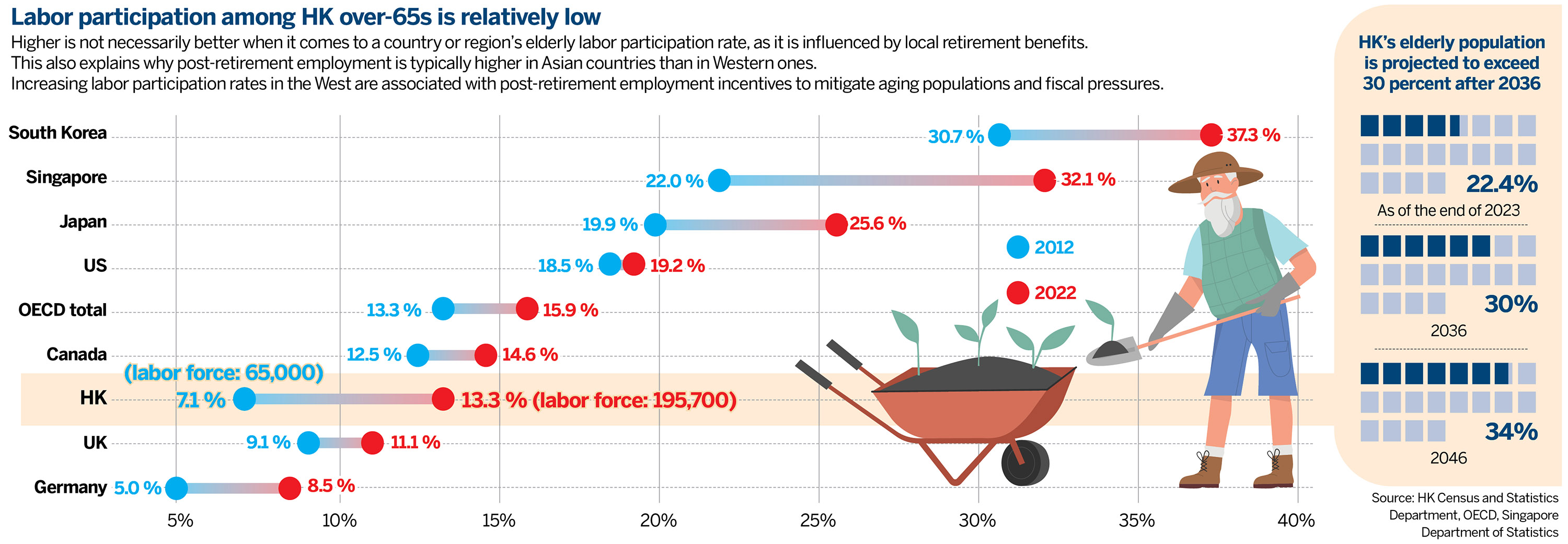

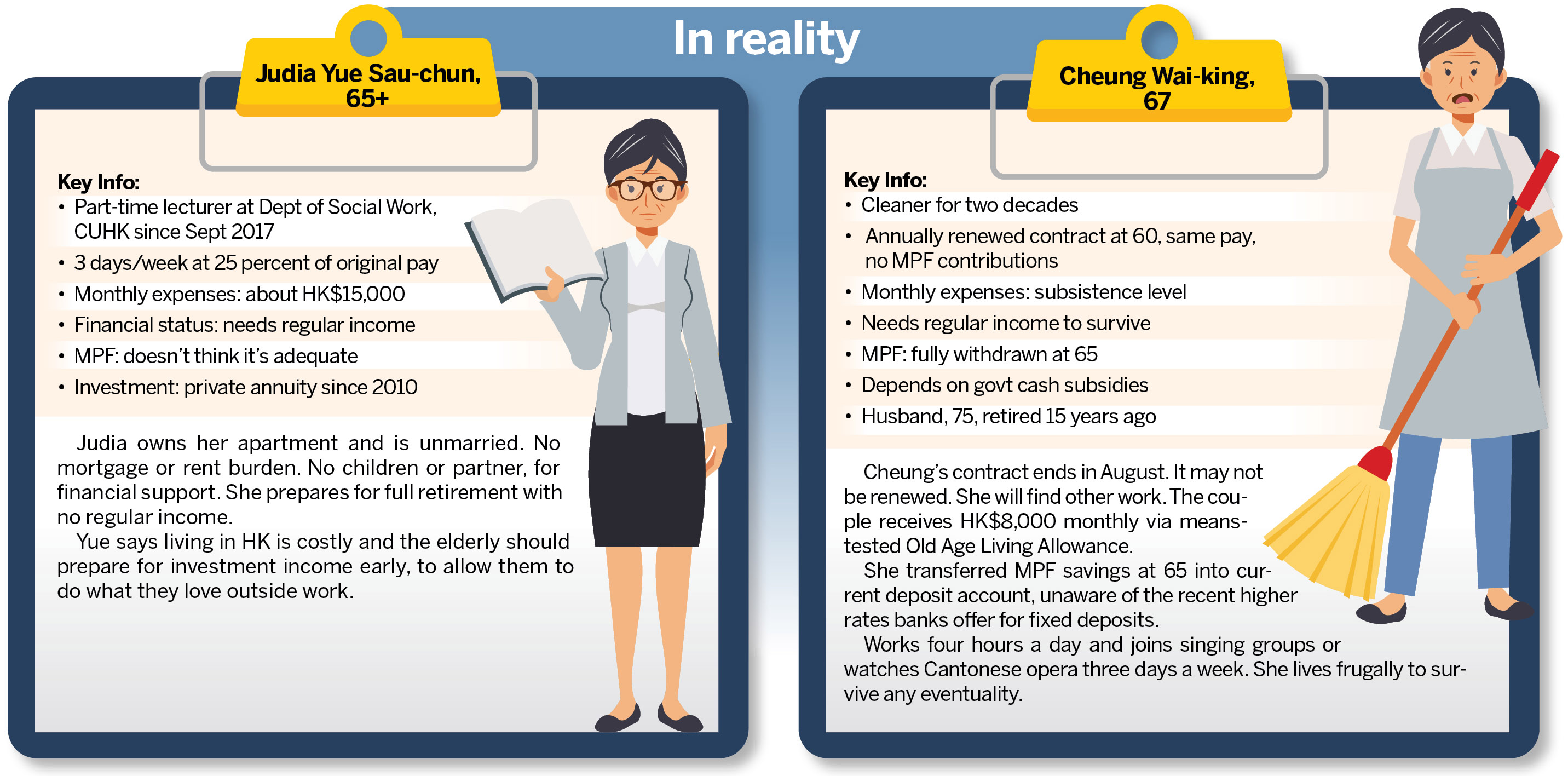

Those over 65 years old who remain in the workforce tripled from 65,000 in 2012 to 195,700 in 2022, representing 13.3 percent of the city’s total labor force. But the elderly labor participation rate remains low compared with that of South Korea at 37.3 percent, Singapore at 32.1 percent, and Japan at 25.6 percent.

READ MORE: ‘Golden’ path to sunset years

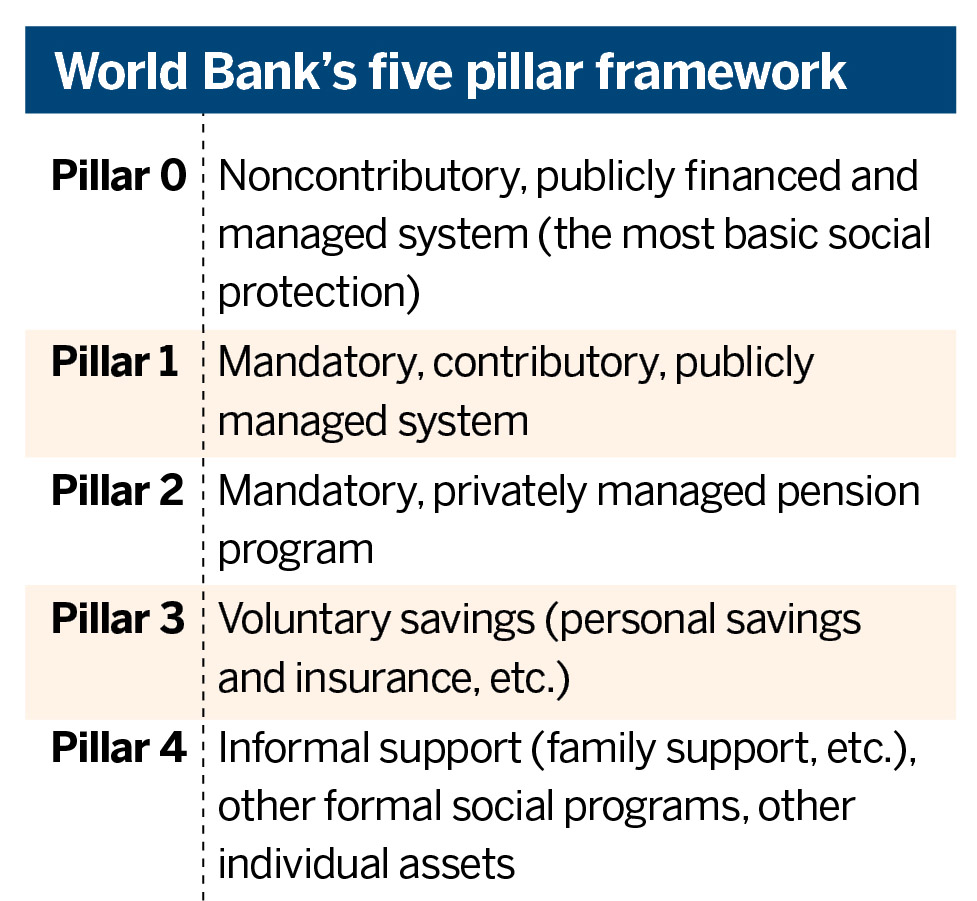

A low fertility rate, small families and cramped living conditions make next-generation support for retired parents limited. The World Bank considers financial support from children to be one of its five pillars for sustainable elderly retirement. The high life expectancies of 82.5 years for males and 87.9 years for females mean that the elderly may face two decades in which to cope financially beyond retirement. In a reply to a China Daily query, the government provided data showing that four out of five retired elderly were living on welfare in 2021.

Retirement fund

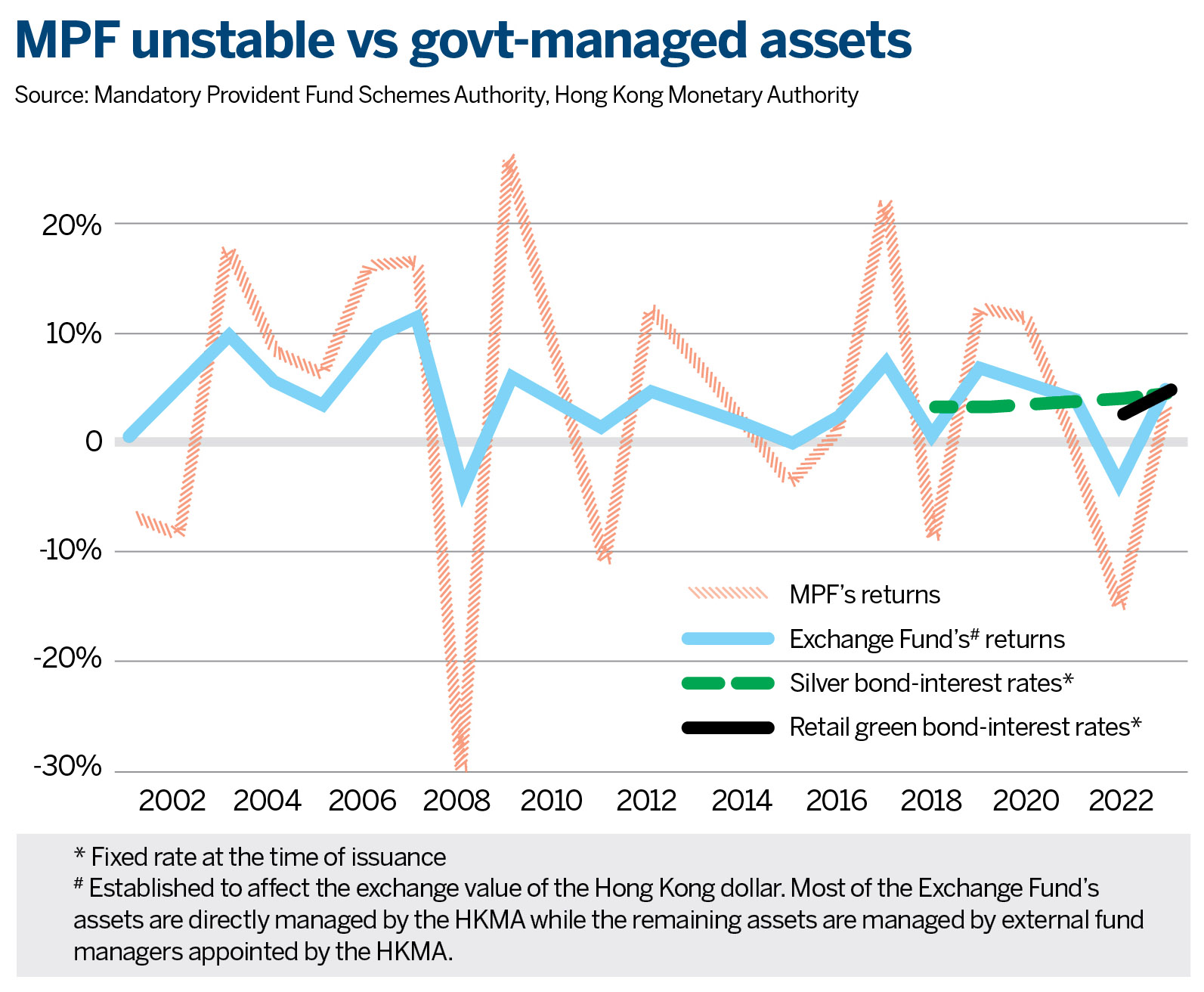

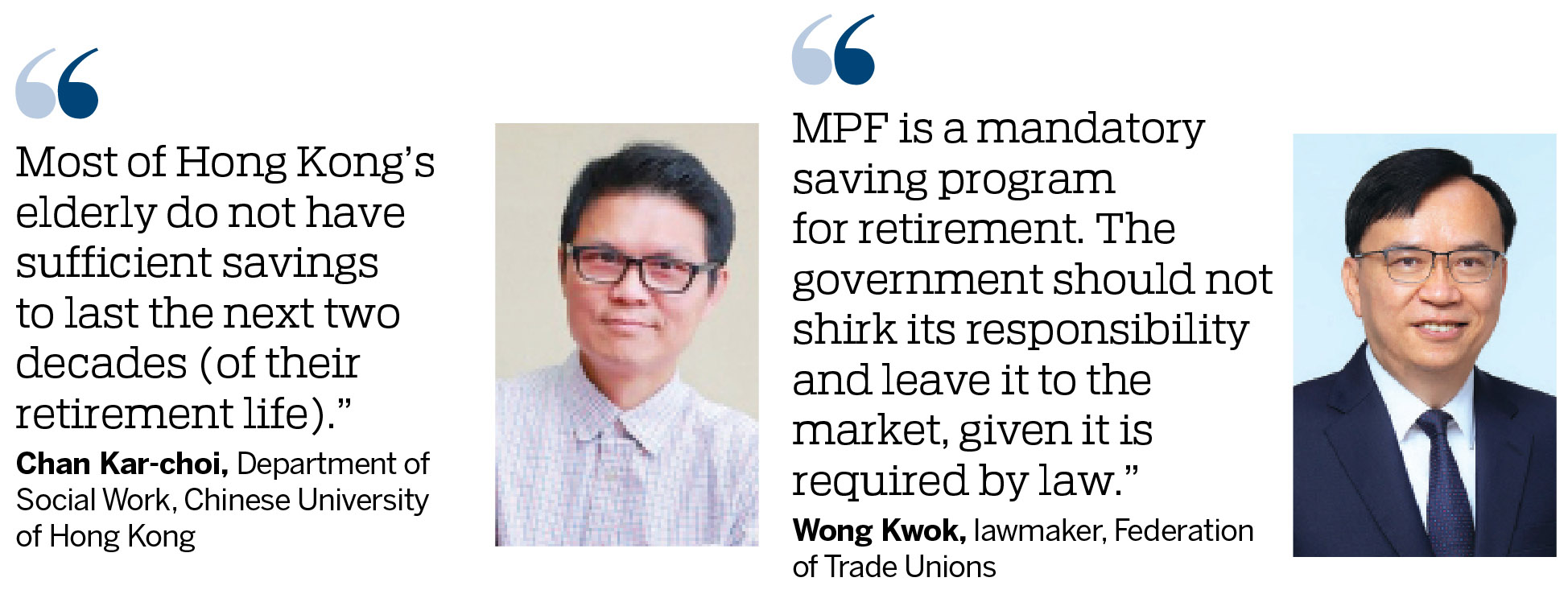

The Mandatory Provident Fund (MPF) is a compulsory pension fund introduced by the Hong Kong Special Administrative Region government in 2000 to alleviate the looming social crisis. Chan Kar-choi, lecturer at the Department of Social Work, the Chinese University of Hong Kong, regards the city’s MPF program as not fit for purpose. He points out that the MPF is tied to the volatility of the stock market, and contrasts this situation with that on the Chinese mainland and in Singapore and Canada, where the government manages the public pension and carries the investment risk. Retirees’ entitlements are not subject to the vagaries of the stock market.

“In Hong Kong, it is risky and dangerous if you rely on the MPF for your retirement,” says Chan. The MPF is an investment-based program which requires financial planning and knowledge — something few residents possess, he adds. Most retirees withdraw and spend their MPF money quickly so they won’t be disqualified from claiming welfare subsidies, as determined by the government’s means-test.

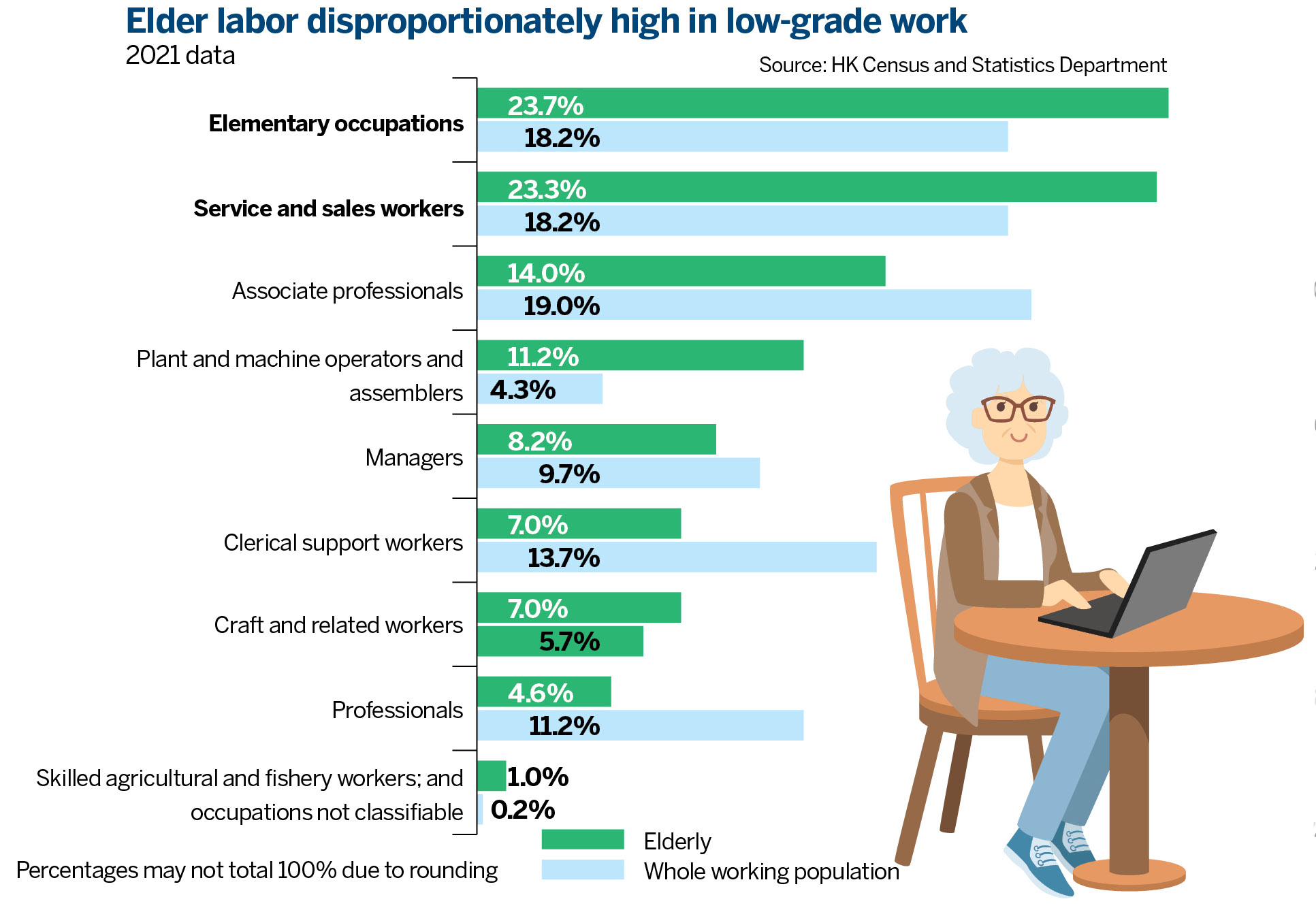

Chan says it is unfortunate that “most people in Hong Kong don’t have enough money to retire on at 65, which leads to a vicious cycle of the elderly becoming trapped in the job market in order to survive.” Furthermore, the reality is that most elderly have to settle for low-income jobs, such as working as cleaners, doormen, and bus drivers.

Phasing-out retirement is a practical option, said Chan, citing the German model whereby employers can reduce the intensity placed on employees aged 65-plus to enable them to continue working until they are 70. Workers can still withdraw part of their pension at 65 years old.

Steve Tsang of the Association of Retired Elderly Ltd, a staffing agency nongovernmental organization that helps place the elderly in jobs, says the elderly typically lack technological know-how and the physical strength to undertake manual work, which limits their options. His organization updates their resumes, coaches them through mock interviews, and matches their attributes to employers’ needs. He points out that the elderly are more loyal and committed at work.

Elderly-work incentives

From Q3 of this year, the city will introduce a three-year program offering HK$10,000 to those aged 40-plus who have been unemployed for over three months if they are able to find work for six months. They stand to gain another HK$10,000 if they find work for a year straight. It is estimated that this program will benefit 6,000 adults.

Earnings under this pilot program will not be factored into the means test for the monthly subsidy of HK$4,195 under the Old Age Living Allowance — subject to an income ceiling of HK$10,710 per month for a single worker. It is hoped that the program will encourage the elderly on welfare to re-enter the job market if they are fit.

Employers will be eligible for a subsidy for each worker aged 40-plus they employ under the existing Employment Programme for the Elderly and Middle-Aged. Chan suggests that contractors bidding for government tenders be given merit points for employing the elderly, and that subsidies be provided to companies to boost training for elderly workers.

Financial Secretary Paul Chan Mo-po, in the 2023 budget, asked the MPF Schemes Authority to study the feasibility of stable-return investment options, by reserving government-issued green and infrastructure bonds as priority investments for the 4 million MPF members. The administration will issue HK$50 billion in silver bonds and HK$15 billion in retail green bonds in the 2024 financial year.

Meanwhile, the SAR is considering doubling the tax deduction for employers’ MPF contributions for employees who are aged 65-plus to nudge them to offer jobs to the elderly, and to make voluntary contributions for them. It is hoped this proposal will pass the legislature and take effect from end-March 2025.

The “offsetting” mechanism which allows employers to raid MPF contributions to pay out severance and long-term benefits to retiring employees will be canceled from May 2025. That mechanism has long been criticized for being unfair and unjust.

Holistic policies

Wong Kwok, a lawmaker representing the city’s largest labor union, the Hong Kong Federation of Trade Unions (HKFTU), says that the lack of proactive policies aimed at encouraging the elderly to work beyond the age of 65, and the shortfall in MPF retirement packages, discourage elderly participation in the workforce. He compares this with the bundle of policies adopted by Singapore and Japan, which include tax incentives, cash allowances and other stimulus measures to encourage the elderly to remain active within the job market.

Wong urges the government to take a proactive approach with the elderly, rather than relying on the market economy to determine the outcomes of MPF gains (or losses) and elderly employment programs. An HKFTU survey found that MPF savings are only sufficient to cover one-third of the financial needs of a retiree. The remaining costs of living have to be found elsewhere. The returns from the MPF are unsatisfactory, and the government should not shirk its responsibility for dealing with this, says Wong.

Can the MPF guarantee a return of 1 percent above inflation? Wong believes the administration would be able to achieve this, if it offers a 5 percent guaranteed return on silver bonds for those aged 60-plus. As an example, he refers to the Hong Kong Monetary Authority’s Exchange Fund of over HK$4 trillion, which achieved a compounded 4.5 percent annual investment return between 1994 and 2023.

ALSO READ: All 24 MPF schemes to migrate to eMPF within 18 months

Wong says that, as MPF contributions after 65 years old are not mandatory, the government should cover them, or compensate employers who do, and contribute to the higher medical insurance costs for the elderly to enable them to remain in the workforce. Establishing a matching fund could also be considered, Wong adds, to evolve a holistic bundle of policies.

What's next

- Attractive tax breaks for employers to hire the elderly

- Allow retirees partial government subsidies to continue working

- Reform MPF to deliver stable returns

- Mandate “Phase-Out” intensity reduction between 65 and 70

- Encourage elder-friendly attitudes in the workplace and society

(INFOGRAPHICS: DONG KAI, MOK KWOK-CHEONG)

Contact the writer at stushadow@chinadailyhk.com