China’s latest fiscal and monetary policies show a profound awareness of the dynamic risks in crucial sectors and a steadfast commitment to addressing these challenges in the coming year, say economists.

At the Central Economic Work Conference last week, the Chinese government identified the stabilization of securities and real estate prices as a key priority for the coming year, marking an unprecedentedly clear commitment to supporting both markets. This was highlighted by Yangchoon Kwak, a professor at Rikkyo University’s College of Economics.

Kwak pointed out that the conference employed the term “moderately accommodative” to describe monetary policy, a phrase last used in 2010 following the global financial crisis triggered by the collapse of Lehman Brothers.

“This signifies a shift toward more proactive fiscal policies and monetary easing, coupled with an enhanced focus on non-traditional counter-cyclical adjustments. These measures illustrate the Chinese government’s deep understanding of dynamic risks in key sectors and its unwavering resolve to tackle these challenges in the year ahead,” he said.

ALSO READ: Xi: China building a high-standard socialist market economy

Regarding concerns about deflation stemming from the bursting of the real estate bubble, Kwak noted that the Chinese government has implemented robust intervention measures not typically seen in other capitalist nations.

These include expanding shareholder returns for publicly listed companies and mandating real estate developers to complete unfinished housing projects. While the effects of these actions may not be immediately visible, Kwak expects its impact to become apparent by next year.

Simultaneously, the Chinese government is advancing a significant debt restructuring plan to address local government debt issues, securing fiscal resources to support growth through this initiative.

“Additionally, thanks to the high birth rates of the 2010s, an increase in labor supply is anticipated. If China can leverage this opportunity and prioritize reforms related to demand – such as boosting income and employment, and improving the social safety net – it could establish a stronger foundation for sustainable growth in the coming years,” Kwak said.

ALSO READ: Expert: China likely largest economy ‘by 2035’

The Chinese economy is projected to grow by around 5 percent this year, contributing nearly 30 percent to global economic growth, according to Han Wenxiu, executive deputy director of the Office of the Central Committee for Financial and Economic Affairs.

Hidetoshi Tashiro, chief economist at Japan’s Infinity LLC, observed that China’s stock indices have been moving within a certain range since Oct 9, signaling that the economic downturn has been contained and a further collapse prevented.

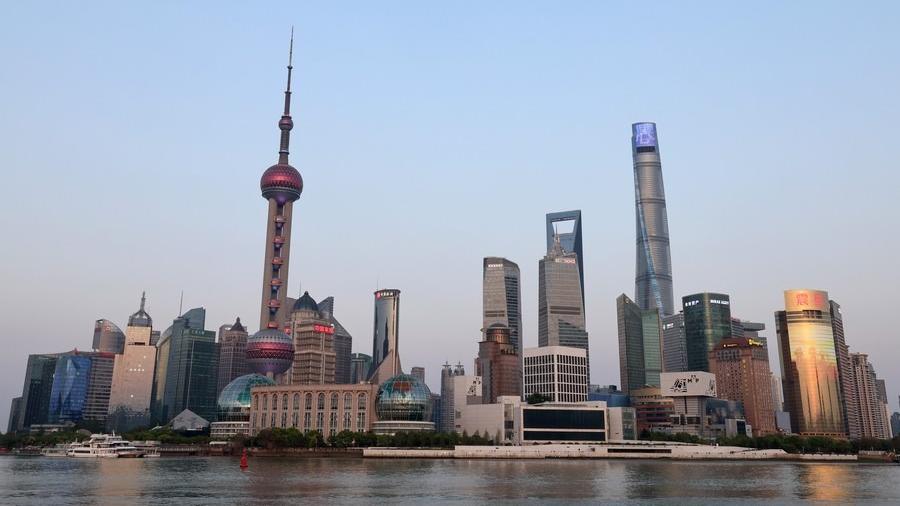

The year-on-year change in the new home price index shows an increase in Shanghai, suggesting that the decline in the city’s real estate market has been halted. However, in cities outside Shanghai, prices continue to fall.

Tashiro cautioned that while the pace of the real estate market’s downturn has slowed, it has not been fully resolved. Consequently, the risk of defaults among smaller financial institutions, including local financing platforms, still remains.

ALSO READ: Large-scale debt swap eyed in China to boost economy

“Drawing from Japan’s painful experience in the 1990s, it is imperative to address nonperforming loans as swiftly as possible next year,” he said.

Tashiro underscored the necessity of transitioning from a macroeconomic policy centered on moderate monetary easing to an active policy mix that combines fiscal and monetary measures. This shift is essential for revitalizing the economy by reducing unemployment and stimulating consumption.

He also pointed out that the private economy’s trajectory will significantly impact China’s economic outlook next year.

“If the private economy promotion law is strictly enforced, leading to increased investment and employment by private enterprises, and if real estate-related nonperforming loans held by small and medium-sized financial institutions, including local financing platforms, are promptly and appropriately managed, China’s economic situation is set to improve next year,” Tashiro said.

ALSO READ: China embraces world economy with unswerving opening-up

He further commented, “If China continues to develop its private economy domestically and promotes free trade internationally, its economy is expected to sustain growth over the medium to long term. As projected by the OECD, it could achieve a scale comparable to the combined size of the United States and the Eurozone by 2060.”

Tetsuro Homma, representative director and executive vice-president at Panasonic Holdings Corp, said: “The Chinese government is taking a proactive approach to addressing the challenges facing its economy. This is a very promising development.”

On Sept 24, China introduced a series of policies aimed at promoting high-quality economic growth. Panasonic has also benefited from initiatives like home appliance trade-in programs.

“Panasonic views China not only as a major manufacturing and consumer market but also as a global hub for innovation and engineering talent. As such, we foreign companies are actively expanding our business operations in China,” Homma said.

READ MORE: China leverages stimulus measures to steer economy

He highlighted that there are currently over 17,000 Japanese companies operating in China, with substantial and diverse investments across the market.

The Japanese Chamber of Commerce and Industry in China conducts quarterly surveys to assess the economic environment and business conditions. According to Homma, over half of the Japanese companies surveyed said they are either maintaining or increasing their investments in China this year.

Xiong Yi, chief China economist at Deutsche Bank, said in a recent report that the recent Central Economic Work Conference underscored plans to promote the stabilization and recovery of the real estate market, including to “vigorously implement urban renewal projects” and “step up efforts to renovate urban villages”.

On the supply side, the government will deal with existing housing inventories and reasonably control new land supply. The pace at which the government will be able to deliver on these commitments will be crucial for the housing sector, Xiong added.

“Boosting consumption is the top priority for 2025,” said Xiong, noting that vigorously boosting consumption came first among the nine policy priorities for 2025. He expects China to also expand services consumption, where additional measures may need to be announced down the road.