A decade after the Chinese mainland opened up its exchanges to a broad swath of international investors through a trading link with the Hong Kong Special Administrative Region, investors are craving deeper access.

With billions of dollars worth of trading volume flowing across the boundary between the HKSAR and Shanghai and Shenzhen on a daily basis, the stock connect has been a success. While the link was later expanded to include bonds, exchange traded funds and interest rate swaps, it has yet to allow investors to access the primary market, or initial public offerings.

Charles Li, one of the key architects of link as then chief executive officer of the Hong Kong Exchanges & Clearing Ltd, said that opening up the primary market was always the ultimate aspiration.

“There is even a greater future for Stock Connect” to allow mainland investors to subscribe to Hong Kong IPOs and vice versa, Li, who stepped down as CEO in 2020, said in an interview.

HKEX Chief Executive Officer Bonnie Chan Yiting declined to give any start date on primary connect saying “everything has its moment” and that with a more robust IPO pipeline “conditions will be riper.”

ALSO READ: HK to link up with more emerging markets, help renminbi go global

“We are just at the beginning,” of the connect program, she said in an interview with Bloomberg TV. HKEX will look at building out connect with more products, better infrastructure and bringing in more participants, she said.

The link is being celebrated at a ceremony in Hong Kong on Monday, with speakers including Chan and her counterparts in Shanghai and Shenzhen, as well as local and mainland regulators.

Turnover is rising again after two sluggish years. The mainland’s recent stimulus measures and market support has also caused trading to surge.

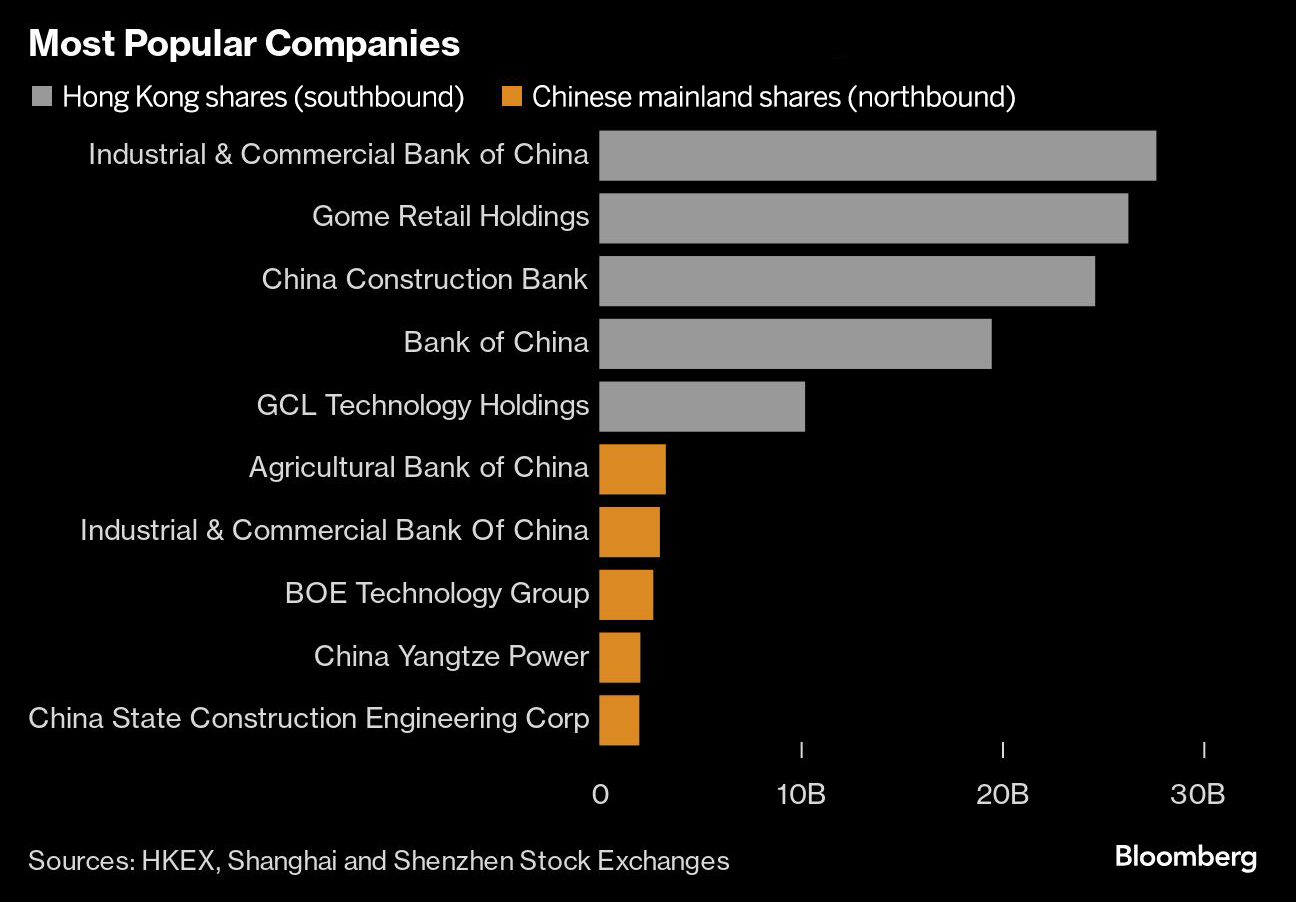

Average daily trading northbound — or into the mainland — has reached about $17 billion a day, while trading southbound has risen to almost $5 billion.

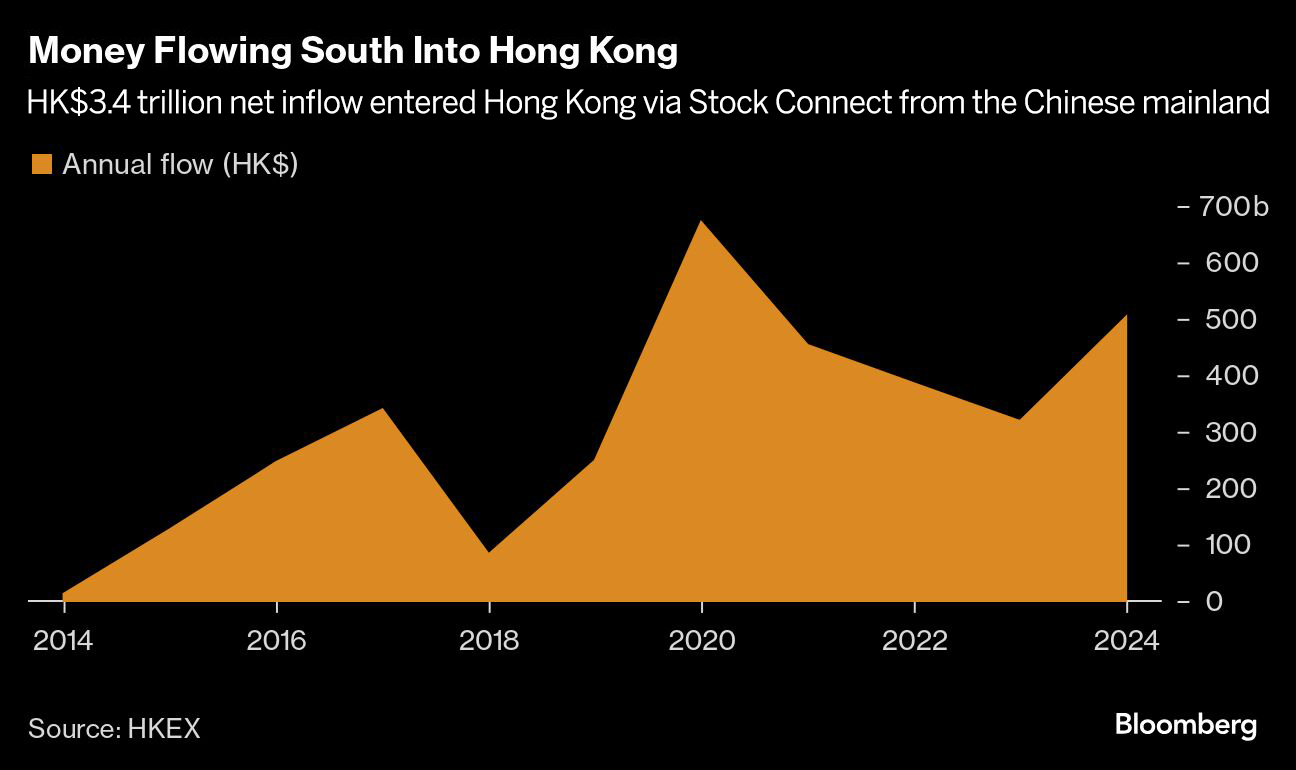

The exchange estimates that net more than 1.8 trillion yuan ($249 billion) has entered mainland stock market from the program. Another HK$3.4 trillion ($436 billion) has flowed into the Hong Kong market, according to HKEX data.

READ MORE: Stock Connect injects $690b into mainland, HK markets over 10 years

The link now accounts for almost 7 percent of mainland daily turnover, and as much as 17 percent of the HKSAR volume. About 3,300 stocks are eligible under the program, covering 43 percent of the available equities and 90 percent of the market capitalization of the three bourses.

Thomas Fang, head of China Global Markets at UBS Group AG, said that while the connect program has been “the most successful financial innovation in the world,” international investors now also need more access to products in futures, Treasury bonds and commodities for risk management.

Kinger Lau, chief China equity strategist at Goldman Sachs Group Inc, said broadening the investment scope for investors and reducing transaction costs could further enhance the value proposition and appeal of Stock Connect.

While Stock Connect is “irreplaceable”, it should add more eligible stocks and lower trading fees to boost liquidity, said Yang Junxuan, a fund manager at Shanghai Junniu Private Fund Management Co, who has used the trading link for five years.

The mainland’s regulator announced in April that real estate investment trusts would be added to the program, though the market is still waiting for a definite start date.