With the nation’s “low-altitude economy” set to emerge as a trillion-yuan business by the end of this decade and become the source of flagship products selling overseas, Hong Kong needs to pull out all stops for a piece of this mega industry. Liu Yifan reports from Hong Kong.

Business opportunities beckon for Hong Kong with the nation’s new economic catalyst featuring aerial machines like drones and electric helicopters poised to replicate the smash hit of electric vehicles in the sky.

Hopes for the “low-altitude economy” — the latest buzzword in China’s patchy economic landscape — are growing against the backdrop of increasing malaise, a property slump, weak consumption and an aging population.

Analysts and business leaders in Hong Kong are optimistic that the aerial business will be the country’s next exports flagship for the advanced manufacturing sector, with a significant role awaiting the special administrative region.

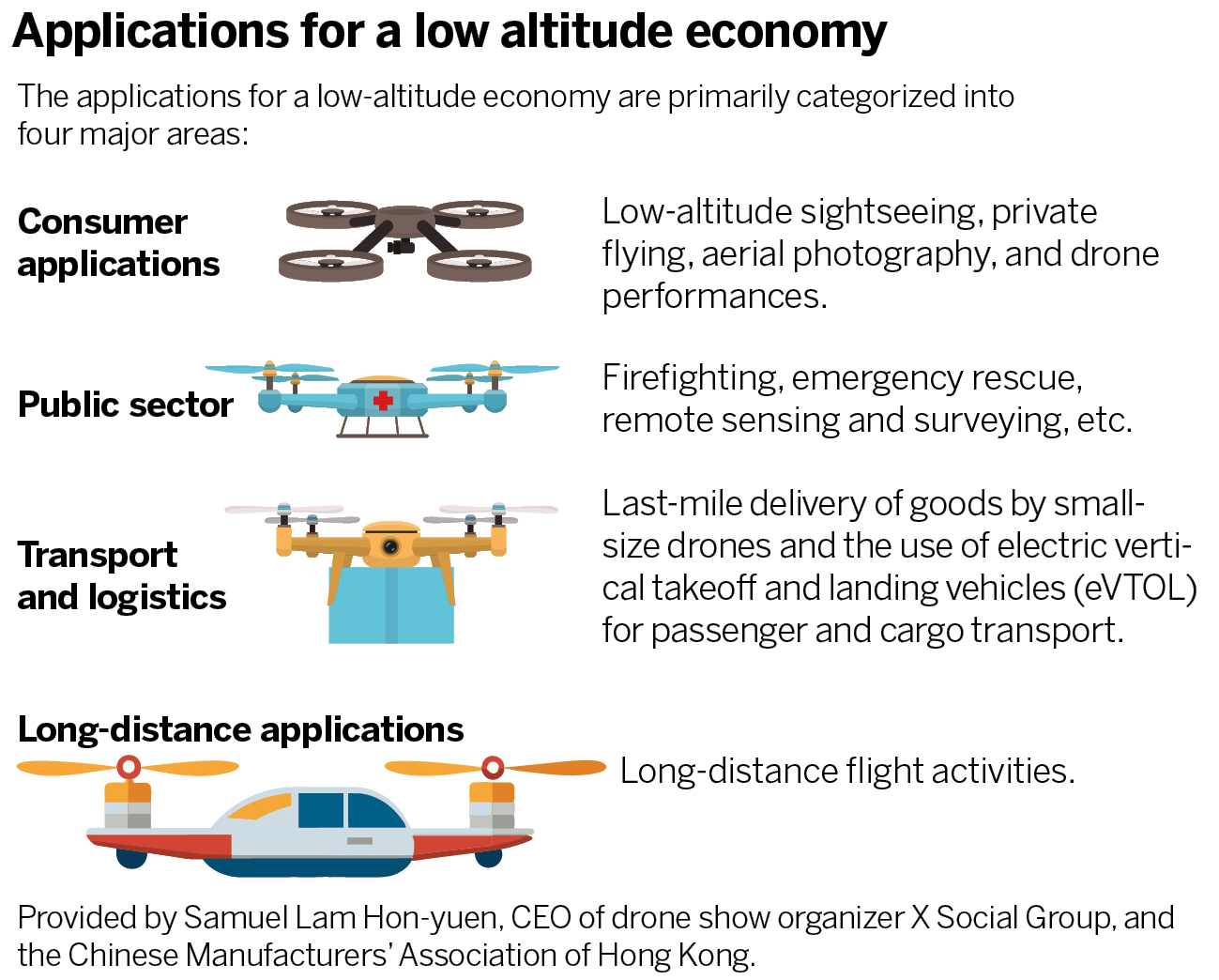

Unlike traditional aviation involving civilian and military flights, the low-altitude economy is characterized by manned and unmanned aerial activities in airspace below 3,000 meters, with labels of renewable energies and intelligent piloting. Its multifaceted industry chain spans drone manufacturing, aviation services, green energy, new materials, and information technology.

READ MORE: HK to reach high for low-altitude economy

Samuel Lam Hon-yuen, CEO of drone show organizer X Social Group, says the low-altitude economy has significant green and environmental characteristics and is becoming an important representative of new quality productive forces — a term that sets old growth models apart from innovative and eco-friendly sectors like electric vehicles.

Henry Hooi Hing Lee, who founded Hong Kong-based green aviation firm Volar Air Mobility, says sound government policy support and incentives are crucial factors both sectors have in common.

The Chinese mainland’s EV growth story can be traced back to 2009 when central-level subsidies were provided to selected public institutions in pilot cities to incentivize their EV purchases. In 2012, the authorities unveiled the inaugural EV industry development plan, outlining targets such as EV production, ownership and vehicle mileage. The subsidy initiative has since been extended to cover all new energy car purchases.

Growing potential

The move is accompanied by fast-expanding charging infrastructure and a wide range of nonfinancial incentives to boost sales, such as exempting EVs from purchase taxes and setting a minimum share of EVs in vehicle procurement for certain public institutions. This led to a surge in electric car sales nationwide in 2015, with a remarkable 343-percent year-on-year sales increase. Riding on a low-carbon drive away from fossil fuel cars to cleaner alternatives, EV sales have emerged as the country’s exports driver due to their competitive prices compared to those of Western manufacturers.

In the domestic market, the EV penetration rate topped 50 percent for the first time in July, according to the China Passenger Car Association. As a battery EV exports behemoth, China leveraged the EV surge last year to surpass Japan as the world’s leading vehicle exporter. As per the American think tank Atlantic Council, China’s total battery EV exports skyrocketed 70 percent to $34.1 billion last year, with the European Union being the primary destination and representing almost 40 percent of these exports.

“Policy-led industrial development is clearly characterized in China,” says Hooi. “With clear signals from the top leadership, the low-altitude economy sector is showing vast potential to become another exports catalyst.”

Global financial services leader Morgan Stanley forecasts the next-generation flight industry to be a trillion-dollar business by 2040. The market size of China’s low-altitude economy sector alone is projected to climb from over 500 billion yuan ($70.27 billion) last year to 2 trillion yuan by 2030, according to the Civil Aviation Administration of China.

Cities in Guangdong province, including tech powerhouse Shenzhen, are at the forefront, with companies like drone makers DJI and Autel Robotics leading the pack, says Ryan Ip, vice-president and co-head of research at think tank, Our Hong Kong Foundation.

He notes that Shenzhen’s drone business generated nearly 75 billion yuan in production output in 2022, accounting for 70 percent of the national total. Consumer drones accounted for 70 percent of the global market share. Provincial capital Guangzhou expects its low-altitude economy to hit 150 billion yuan by 2027. “This sector offers potential solutions for urban challenges in densely populated areas like Hong Kong, particularly in transportation and logistics,” says Ip.

A tailwind is that technologies adopted in EVs are highly transferable to low-altitude economic applications, according to experts. Take electric vertical takeoff and landing (eVTOL) aircraft, also known as flying taxis, as an example. Burt Guo, CEO of Aerofugia Technology — a subsidiary of Chinese carmaker Geely — says he believes eVTOL aircraft could take an 80-percent share of the supply of EV materials and components.

Among the critical parts of the next generation of flights is the battery, which has been widely adopted in new energy cars, says Koh Weng Siang, co-founder and vice-president of Volar Air Mobility. “This gives China a clear edge to push forward the low-altitude economy agenda.”

A case in point is China’s Contemporary Amperex Technology — the world’s largest EV battery producer. Commanding more than 37 percent of the global market last year, the company supplies batteries to both domestic brands and international carmakers like Tesla and BMW.

Bridging innovation

What sort of role can Hong Kong play in this megatrend? Lawrence Iu Chun-yip, executive director of Civic Exchange, would like to see the city position itself as an “agent and middleman” to bridge mainland technological applications with those of the world, given the discrepancy in aviation standards.

The HKSAR could help mainland companies engaged in the low-altitude economy to get international approval for linking the standards required, which could help the sector tap the global market.

“The HKSAR government has been very active in bridging mainland technology with the world,” says Iu. “We definitely have to think about how to use the low-altitude economy to make Hong Kong a hub for innovation, and work with cities in the Guangdong-Hong Kong-Macao Greater Bay Area to fulfill our role.”

Lam stresses the importance of the city’s common law system — a legal foundation that contributes to its role as a “superconnector” by linking the mainland with the global community.

Lam’s company, X Social, has helped the mainland’s drone businesses expand to some 20 countries, including those in Southeast Asia and the Middle East. He says many contracting parties tend to clinch deals in Hong Kong as businesses see legal issues as a major concern in other jurisdictions.

Another telling example is Volar Air Mobility. The startup is stepping up efforts to help an electric aircraft model developed by a mainland State-owned partner become commercially successful globally. Ex-banker Hooi highlights the green aviation funding potential enabled by carbon credit offset mechanisms, which play into Hong Kong’s strength as an international financial and green center.

According to co-founder Koh, Volar seeks to tap the Southeast Asian economies as the first step, followed by the Middle East, Europe and Africa.

Hong Kong’s strengths in green finance are also an asset. As a leading green finance center, developing the low-altitude economy can maximize the city’s traditional and innovative green financing channels to help companies raise capital at relatively low interest rates, says Ip.

While established firms may benefit from traditional green bonds and loans, early-stage or unproven companies in this sector often face challenges accessing such products due to perceived higher risks. To close the gap, innovative green financing channels, such as sustainability-linked bonds with specific low-altitude economy metrics, venture capital, and government-backed funds that focus on green investments, can be utilized.

Strong headwinds

Despite positive signs, the low-altitude economy’s go-global vision still faces strong headwinds in the form of regulatory and technological challenges, as well as geopolitical instability.

“Its success will largely depend on overcoming regulatory hurdles, ensuring safety, gaining public acceptance, as well as continued innovation in both technology and business models,” says Ip, citing propulsion systems, flight control systems, airframes, and navigation systems as critical parts, apart from batteries.

Although the technologies involved are similar to those for EVs, applications in electric flights may have to follow more stringent rules and standards for safety reasons. “If these challenges are met, it could indeed become another powerful representation of Chinese innovation and export capability in the global market,” he says.

ALSO READ: Creating business in the air

Lingering geopolitical risks could also present obstacles. The European Union has raised tariffs by up to 38 percent on Chinese electric cars. It followed the US decision to quadruple duties on Chinese EVs to 100 percent in May to boost its domestic manufacturing and jobs. It is unclear whether trade curbs would be imposed on electric aircraft.

What matters now is how to strike a balance between regulations and development across the globe. Citing Hong Kong as an example, Lam says drone flights primarily occur at heights of 90 meters above the ground to avoid conflicts with helicopters and other aircraft in use. However, current regulations require operators of small drones to apply to the Civil Aviation Department for permission to fly in unenclosed areas, thus limiting their operational flexibility.

Another obstacle is that there are still various airspace control zones in Hong Kong, including areas around Victoria Harbour, airports and hospitals. Existing aviation regulations stipulate that drones cannot exceed 25 kilograms, making them unsuitable for carrying passengers in the city.

Opportunities do exist for Hong Kong. But, the city will need to work hard to make things happen.

Contact the writer at evanliu@chinadailyhk.com